| | |

|

Last Week in Review: Headline Risk Highlights Christmas Week

Forecast for the Week: Final Jobs Report for 2018

View: Discover What You Need on Your Website

| |

| | |

|

| | |

|

The financial markets had plenty to cheer about this week. On Wednesday, Stocks rallied a stunning 1,000+ points, enjoying their best one-day gain in history and then rallied over 800 points higher intraday on Thursday, erasing a huge midday loss. All in all, a great and welcome week in what was otherwise a miserable December for Stocks.

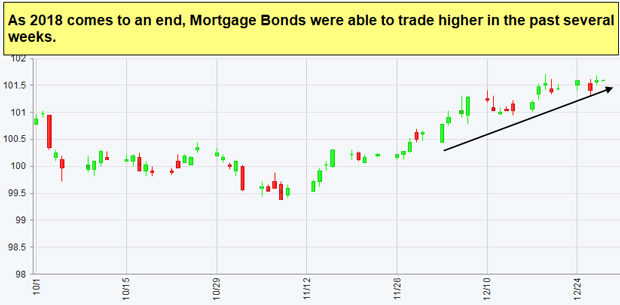

Typically, higher stock prices mean higher home loan rates but that wasn't the case this holiday week. Yes, Bonds moved slightly lower and home loan rates slightly higher in response to the swift Stock rally, but rates ended the week and head into 2019 near the best levels since spring.

The high volatility in the markets is likely to continue well into 2019 as Stocks and Bonds continue to bounce around in response to the U.S. government shutdown, U.S./China tariffs, China slowdown, European issues and uncertainty around the Fed.

Is this good news for home loan rates and housing? Inflation is in line with the Fed's expectations and bond yields in other parts of the world remain low due to slower economic growth which means that home loan rates should remain relatively low for the foreseeable future.

If you or someone you know has questions about home loans, give me a call. I'd be happy to help.

| |

| | |

|

| | |

|

The first week of 2019 is also holiday shortened and may also be extremely volatile as the financial markets will react to the December Jobs Report on Friday. There is no expected delay on releasing the Jobs Report should the government still be partially closed.

There will also be several manufacturing reports released during the week, but everything takes a back seat to the Friday Jobs release.

Why? The Fed has stated they are "data-dependent" when it comes to future rate hikes, meaning they are looking at important readings like the Jobs Report in determining the future path of short-term interest rates.

The recent selloff in Stocks has been largely caused by fears the Fed will be too aggressive hiking interest rates in 2019. The Jobs Report may give early clues on what to expect with rate hikes in 2019 and it could be a market moving event this week.

The Bond markets close early on Monday, New Year's Eve at 2:00 p.m. ET. Stocks are open for a normal session. All U.S. markets are closed on Tuesday for New Year's Day.

Reports to watch:

- The Chicago PMI will be released on Wednesday followed by the ISM National Manufacturing Index on Thursday.

- ADP Private Payrolls will be released Thursday due to the holiday shortened week.

- The government's Jobs Report for December will be released Friday and includes Non-Farm payrolls, the Unemployment Rate and Hourly Earnings.

| |

| | |

|

| | |

|

Tip: Video, Audio, and Images, Oh My! What Do I Really Need on My Website?

In the digital age, your website is your calling card. It's one of the first places potential customers will go to find out information about you and your business. Since having the right look and information is so crucial, you may also find yourself asking which types of multimedia do you really need on your website.

Having the right mix of multimedia can:

- Attract visitors to your site and keep them engaged longer.

- Improve SEO for your website.

Multimedia is known to improve company and personal branding, as visitors are becoming more visual and looking for multiple types of resources to gather information.

So the simple answer is yes, you should add a good mix of video, audio and image content to your website, but make sure it's done properly. Follow these quick tips on website multimedia.

- Optimize your image size and video speeds so the page doesn't have lag when loading and videos can be easily watched without interruption.

- Include relevant keywords in descriptions, file name, and alt text.

- Make sure your video and audio content is not set to autoplay. Having your videos and audio files start without interaction from the user can be startling and disruptive and cause the reader to click off quickly.

Adding videos, audio files, and images is a fantastic way to improve visitor interaction and increase SEO as long as it's done right and doesn't create any disruption when viewing the website.

Sources: Cincopa, Hubspot

Economic Calendar for the Week of December 31 - January 04

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

| Tue. January 01 |

01:00

| ADP National Employment Report |

NA

|

NA

|

|

NA

|

Low

|

| Wed. January 02 |

08:30

| Chicago PMI |

Dec

|

NA

|

|

66.4

|

Moderate

|

| Thu. January 03 |

08:15

| ADP National Employment Report |

Dec

|

NA

|

|

179K

|

HIGH

|

| Thu. January 03 |

08:30

| Jobless Claims (Initial) |

12/29

|

NA

|

|

NA

|

Moderate

|

| Thu. January 03 |

10:00

| ISM Index |

Dec

|

NA

|

|

59.3

|

HIGH

|

| Fri. January 04 |

08:30

| Average Work Week |

Dec

|

NA

|

|

34.4

|

HIGH

|

| Fri. January 04 |

08:30

| Non-farm Payrolls |

Dec

|

NA

|

|

155K

|

HIGH

|

| Fri. January 04 |

08:30

| Unemployment Rate |

Dec

|

NA

|

|

3.7%

|

HIGH

|

| Fri. January 04 |

08:30

| Hourly Earnings |

Dec

|

NA

|

|

0.2%

|

HIGH

|

|

|

| | |

This credit union is federally insured by the National Credit Union Administration (NCUA). Accounts and shares are insured by the Administration to the maximum insurance amount for each member or shareholder. Unless otherwise noted, fees may be associated with certain products and services. Certain UNFCU products and services are subject to approval. Federal and state laws may limit the availability of certain products and services in select areas. UNFCU is a registered mark of the United Nations Federal Credit Union.

|

No comments:

Post a Comment