| | |

|

Last Week in Review: No rate hikes in 2019. Who wins?

Forecast for the Week: Plenty to follow this week

View: Tips for using infographics

| |

| | |

|

| | |

|

"We are good where we stand right now"...Fed President James Bullard - 1/10/19

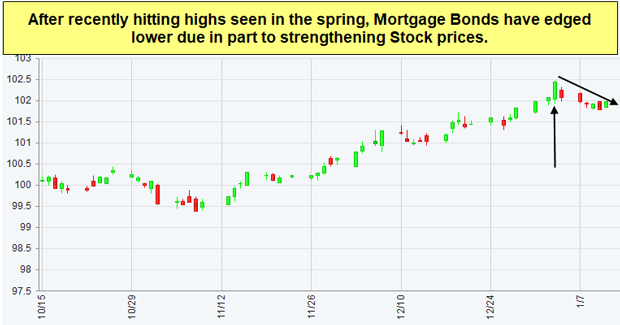

Stocks continued to react positively to Fed Chair Powell's Jan 4th speech, where he essentially said, "we have your back"...meaning that the Fed will be "flexible" and may not raise rates at all in 2019.

There is an old saying in the financial markets - "don't fight the Fed." This means that if the Fed is saying or doing something (hinting no rate hikes) that helps Stocks, that theme will continue until the story changes.

Typically, when stocks move higher, so do long-term rates, like home loans. And this past week, we saw the recent nice trend of lower rates get disrupted.

Even though the recent trend of lower rates, the lowest since the Spring, is very much at risk - we should not expect long-term rates to move too high. Why? Inflation is not a threat.

Fed President Bullard, quoted above, also said he expects inflation to be near current levels for the next FIVE years. If that is the case, home loan rates will remain relatively attractive for longer than most expect.

If you or someone you know has questions about home loans, give me a call. I'd be happy to help.

| |

| | |

|

| | |

|

The Fed is very much "data-dependent", meaning they will watch the incoming economic reports to help them determine their next move with interest rates. And this week brings a full slate of economic reports including numbers on housing, manufacturing, consumer spending and overall sentiment.

It would take a surprising positive change in economic data to cause the Fed to hike rates before June.

Some economic data, like Retail Sales and Housing Starts, may not be released if the government shutdown continues.

The uncertainty behind the ongoing U.S. government shutdown and U.S./China trade dispute continues to provide support for Bonds and home loan rates. Should these events come to a positive resolution, Bonds may drop, and rates may rise. The opposite is true.

Reports to watch:

- The wholesale inflation reading Producer Price Index will be released on Tuesday.

- Manufacturing data from Tuesday's Empire State Index will be followed by the Philadelphia Fed Index on Thursday.

- Retail Sales may be released on Wednesday, given the government shutdown situation.

- Housing data from the NAHB Housing Market Index will be delivered on Wednesday and possibly Housing Starts and Building Permits on Thursday.

- Weekly Initial Jobless Claims will be announced on Thursday.

- Friday brings Consumer Sentiment.

| |

| | |

|

| | |

|

Tip: How to Use an Infographic to Your Advantage

Staying motivated can be one of the most difficult challenges in the real estate industry you may face. While having established goals and a clear future path are integral components of staying motivated, another crucial component is being able to cut out common distractions.

Infographics are a great way to break down and share complex, detailed information in a way that is easily digestible for your customers. Visual representations of important data can keep readers interested in difficult content for longer and help them understand what they are reading. Here are a few simple steps you can take to make sure that your infographics work to your advantage.

- You'll need to optimize your infographic to make it search engine friendly. No matter how amazing your infographic is, if it is not seen, it will have little effect. To get the most from your infographics, there are three primary elements that you need to focus on: file name, alt text, and meta description. Your file name should be as descriptive and concise as possible. The alt text should give your readers context for the infographic, and the meta description should be straightforward and include a call to action.

- When creating infographics, innovation is key. You can make simple modifications to provide a new, inventive approach to conveying the information. Interactive charts and unique animations are great for calling attention to the important facts you want to present. Always make sure that the data is clear and easy to understand, but give each infographic a unique twist or design that will engage the reader.

An Infographic can help you achieve your content goals if it summarizes some of the key content of the post that accompanies it. Use your infographics to your advantage by making them easy to comprehend, SEO-friendly, and visually appealing.

Source: Maximize Social Business

Economic Calendar for the Week of January 14 - January 18

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

| Tue. January 15 |

08:30

| Producer Price Index (PPI) |

Dec

|

NA

|

|

0.1%

|

Moderate

|

| Tue. January 15 |

08:30

| Core Producer Price Index (PPI) |

Dec

|

NA

|

|

0.3%

|

Moderate

|

| Tue. January 15 |

08:30

| Empire State Index |

Jan

|

NA

|

|

10.9

|

Moderate

|

| Wed. January 16 |

14:00

| Beige Book |

Jan

|

NA

|

|

NA

|

Moderate

|

| Wed. January 16 |

08:30

| Retail Sales |

Dec

|

NA

|

|

0.2%

|

HIGH

|

| Wed. January 16 |

08:30

| Retail Sales ex-auto |

Dec

|

NA

|

|

0.2%

|

HIGH

|

| Wed. January 16 |

10:00

| Housing Market Index |

Jan

|

NA

|

|

56

|

Moderate

|

| Thu. January 17 |

08:30

| Philadelphia Fed Index |

Jan

|

NA

|

|

9.4

|

HIGH

|

| Thu. January 17 |

08:30

| Housing Starts |

Dec

|

NA

|

|

1.256M

|

Moderate

|

| Thu. January 17 |

08:30

| Building Permits |

Dec

|

NA

|

|

1.328M

|

Moderate

|

| Thu. January 17 |

08:30

| Jobless Claims (Initial) |

1/12

|

NA

|

|

NA

|

Moderate

|

| Fri. January 18 |

10:00

| Consumer Sentiment Index (UoM) |

Jan

|

NA

|

|

98.3

|

Moderate

|

|

|

| | |

This credit union is federally insured by the National Credit Union Administration (NCUA). Accounts and shares are insured by the Administration to the maximum insurance amount for each member or shareholder. Unless otherwise noted, fees may be associated with certain products and services. Certain UNFCU products and services are subject to approval. Federal and state laws may limit the availability of certain products and services in select areas. UNFCU is a registered mark of the United Nations Federal Credit Union.

|

No comments:

Post a Comment